A Mutual Fund Is An Investment Tool That Pools Money From Investors With A Common Investment Objective. It Then Invests The Money In Different Asset Classes Like stocks And Bonds Based On The Scheme’s Purposes. An Asset Management Company Makes These Investments On Behalf Of The Investors And Against Their Will. You Can See The Mutual Fund Is Handled By A Professional Expert, Which Is To Ensure Your Money On Behalf Of Many Investors. This Is The Safest Way To Invest In Other Funds, And This Is Useful.

A Mutual Fund Is An Investment Tool That Pools Money From Investors With A Common Investment Objective. It Then Invests The Money In Different Asset Classes Like stocks And Bonds Based On The Scheme’s Purposes. An Asset Management Company Makes These Investments On Behalf Of The Investors And Against Their Will. You Can See The Mutual Fund Is Handled By A Professional Expert, Which Is To Ensure Your Money On Behalf Of Many Investors. This Is The Safest Way To Invest In Other Funds, And This Is Useful.

• Immediate And Relatively Cheap Diversification

• Well-Organised Risk Administration

• Dynamic Management Of Portfolios

• Groundbreaking Models For Investment And Withdrawal

• Lower Transaction Costs

• Low Taxable

• Long-Term Planning

• Short-Term Advantage

• Low Risk

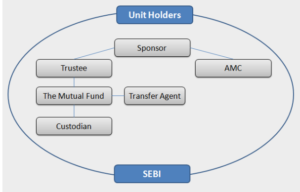

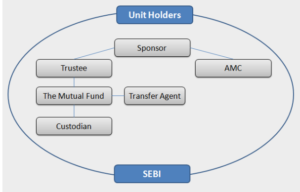

Structure Of A Mutual Fund

There Are Three Parties Involved In The Process: The Sponsor, Who Creates A Mutual Fund; The Trustees; And The Asset Management Company, Which Oversees The Fund Management. The Model Of Mutual Funds Has Come About Because Of The SEBI Mutual Fund Regulations, 1996. Under These Regulations, A Mutual Fund Is Started As A Public Trust.

The Fund Sponsor

The Organiser Or General Partner Of A Private Equity Or Venture Capital Investment Fund The Sponsor Is Effectively Run By One Or More Private Equity Or Venture Capital Investment Professionals Who Have Responsible Knowledge Of The Market And Have Good Experience With Market Fluctuations. The Investment Fund Is Typically Formed As A Limited Partnership Or A Limited Liability Company.

Example

HDFC Bank Is The Sponsor Of HDFC Mutual Fund. Birla Sun Life Mutual Fund, Aditya Birla Financial Services, And Sun Life (India) Amc Investments Inc. Are Sponsors.

Once SEBI Agrees To The Establishment, A Public Trust Is Made Under The Indian Trust Act Of 1882, And This Is Registered With Sebi. Trustees Are Recruited To Manage The Trust, And An Asset Management Company Is Formed, Complying With The Companies Act Of 1956.

Trust And Trustees

In Addition To Assuming Legal Ownership Of The Assets Taken By A Trust, A Trustee Also Assumes Fiduciary Responsibility For Managing Those Assets And Achieving The Goals Of The Trust. Trustees Can Be Appointed In Two Ways. 1. A. Trust. A Trustee Company 2. A Board Of Trustees The Trustees Work To Monitor And Control The Activities Of The Mutual Fund And Check Its Investment Strategy Against Sebi Regulations.

The Trust Is Created By A Sponsor, Or More Than One Sponsor, Who Is Like A Promoter Of A Company. The Trustees Of The Mutual Fund Took And Used Its Property For The Benefit Of The Unitholders.

Asset Management Companies

An Asset Management Company Is A Firm That Invests An Ocean Of Funds From Clients, Putting The Capital To Work Through Different Investment Styles Or Strategies, Including Stocks, Bonds, Real Estate, Master Limited Partnerships, And More.

Amcs Vary In Terms Of Their Size And Capital Handled, From Personal Money Managers That Handle High-Net-Worth Individual Accounts And Have Some Hundred Million Dollars In Aum To Big Investment Companies That Offer ETFs And Mutual Funds And Have Trillions In Aum.

The AC Is Liable For All schemes And Fund-Related Activities. It Has Various Schemes, And They Launch The Same Way As Their Names. The AC Is Bound To Manage Funds And Provide Services To Investors.

Custodians

Security And Management Of The Securities Held Within A Mutual Fund Are The Responsibility Of Mutual Fund Custodians. The Securities Owned By A Fund Are Held As Agents With The Custodian And Not Directly With The Fund, Though The Portfolio Manager Of The Fund Makes Trading Decisions.

Registrar And Transfer Agents

A Registrar And Transfer Agent Act As Mandatory Agents Between Investors And Mutual Fund Houses. These Financial Institutions Recruited RTAs To Manage And Maintain Proper Records Of Investors’ Data And Information. R&T Agents maintained Proper Records Of Essential Investor Data Such As Account Balances And Transactions.

Mutual Fund Categories

SEBI Specified And Approved Mutual Fund Schemes

• Equity Schemes.

• Debt Schemes.

• Hybrid Schemes.

• Solution Oriented Schemes: For Retirement And Children

A Mutual Fund Is An Investment Tool That Pools Money From Investors With A Common Investment Objective. It Then Invests The Money In Different Asset Classes Like stocks And Bonds Based On The Scheme’s Purposes. An Asset Management Company Makes These Investments On Behalf Of The Investors And Against Their Will. You Can See The Mutual Fund Is Handled By A Professional Expert, Which Is To Ensure Your Money On Behalf Of Many Investors. This Is The Safest Way To Invest In Other Funds, And This Is Useful.

A Mutual Fund Is An Investment Tool That Pools Money From Investors With A Common Investment Objective. It Then Invests The Money In Different Asset Classes Like stocks And Bonds Based On The Scheme’s Purposes. An Asset Management Company Makes These Investments On Behalf Of The Investors And Against Their Will. You Can See The Mutual Fund Is Handled By A Professional Expert, Which Is To Ensure Your Money On Behalf Of Many Investors. This Is The Safest Way To Invest In Other Funds, And This Is Useful.